Texas offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Texas Renewable Energy Credit

Texas Gas Service

Texas-New Mexico Power Company

Entergy Texas, Inc.

Bryan Texas Utilities

Entergy eTech

Frontier Associates and Clean Energy Associates

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Texas State Capitol

1100 Congress Ave.,

Austin, TX 78701

(512) 463-4630

[email protected]

Hours: M-F 7:00am – 8:00pm

Sat-Sun 9:00am – 8:00pm

Oncor

124 East Industrial Boulevard

Cleburne TX 76031-1382

(888) 313-6862

[email protected]

Hours: M-F 8:00am – 6:00pm

Texas State Energy Conservation Office

111 East 17th Street, 610D

Austin, Texas 78774

(512) 463-1931

Toll-Free: 1-800-531-5441, ext 3-1931

[email protected]

Hours: M-F 8:00am – 5:00pm

Amarillo Holly Weather Bureau

1900 English Road

Amarillo, TX 79108

(806) 335-1121

[email protected]

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Property Tax Exemption | 100% of the increased home value | Individuals who install a solar energy system |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Texas State Energy Conservation Office

SECO Funding & Incentives

Alternative Fuels Program

Clean Energy Incubators

Industrial Energy Efficiency

Contact

Power Outage Map

Texas Commission on Environment Quality

Phone: 512-239-1000

Email: [email protected]

Monday – Friday

8 AM – 5 PM

TCEQ

12100 Park 35 Circle

Austin, TX 78753

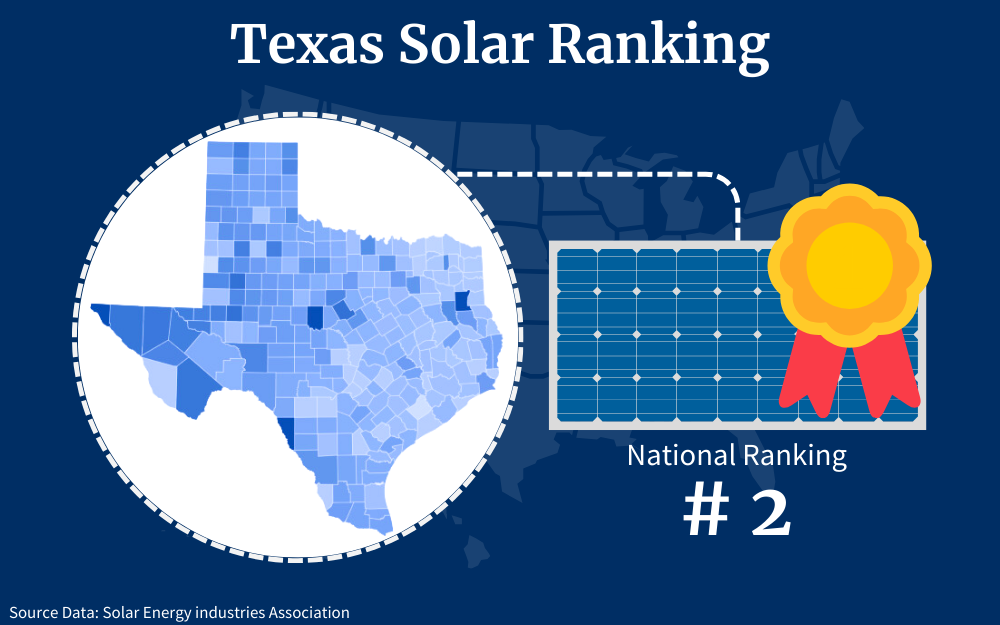

When you consider the fact that Texas ranks second in the nation for installed solar capacity, it makes sense that there are plenty of Texas solar incentives for folks in the ‘Lone Star State’ to take advantage of.1

People who want to go solar in Texas but have concerns about the cost have numerous Texas solar incentives to choose from that make the price of panels more manageable.

What Solar Credits Are Available in Texas?

This complete guide outlines the incentives, rebates and credits you can get to reduce the cost of home solar energy installation, which can make you independent from the power grid.

Although Texas does not offer an overarching, statewide solar rebate program, there are several Texas solar incentives available throughout the state, as well as property tax exemptions and net metering opportunities.

Along with these state-specific options, Texas residents can also benefit from the federal solar investment tax credit, also known as the Residential Clean Energy Credit; previously called the Solar Investment Tax Credit (ITC).2

Tax credits like this offer dollar-for-dollar reductions in the income tax someone owes. For example, if someone claimed a $1,000 federal tax credit, that would decrease that person’s income taxes that were due by $1,000.

The federal solar tax credit is a 30% credit applicable to solar equipment installed between 2022 and 2032. After 2032, it will decrease to 26%, and it will drop again to 22% in 2034.

EERE Programs Explained: Residential Solar Tax Credits

The various solar credits and incentives are sometimes described collectively as Energy Efficiency and Renewable Energy or EERE programs.3

Here’s a breakdown of the EERE residential solar programs for which Texans can apply:

Residential Clean Energy Credit

The Residential Clean Energy Credit allows you to subtract 30% of the costs of new solar equipment.4

The following are among the specific pieces of equipment you can install that are included in the federal tax credit:

- Solar PV panels

- Contractor labor (including site preparation, assembly, and installation)

- System balancing and mourning equipment, including wiring and inverters

- Energy storage devices with a capacity rating of at least 3 kilowatt-hours

- Sales taxes on any of these eligible expenses

This credit is nonrefundable. That means that if the credit amount exceeds your taxes owed, you won’t get a refund from the government for the balance. However, you can carry the remainder and apply it to next year’s taxes.

The federal solar tax credit doesn’t have any lifetime dollar limits. You can also claim it every year that you install new and eligible equipment.

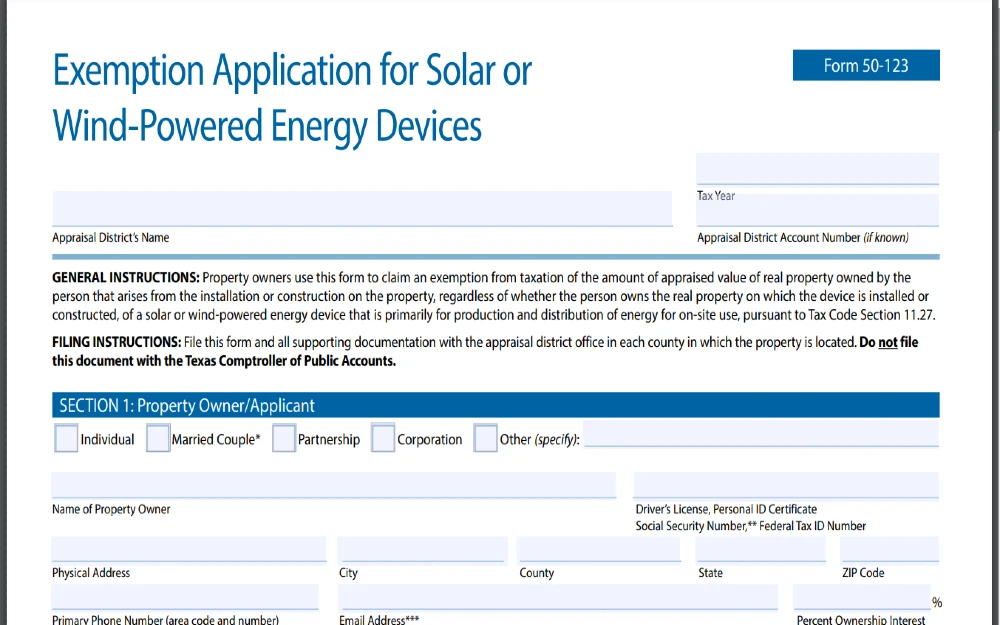

Renewable Energy Systems Property Tax Exemption in Texas

After installing a solar panel system on your Texas home, you don’t have to pay any additional property taxes related to an increase in the home’s value.5

Say your home is valued at $350,000 and you install a $20,000 solar panel system. Your property taxes would still be calculated based on the $350,000 valuation.

Residential Solar Program From Oncor

This residential program is a one-time incentive for residents in the Oncor service territory, which includes the Dallas-Fort Worth area. It’s available for solar panels home with batteries ranging from three to 15 kilowatts and can produce up to $9,000 in savings per system.6

SMART Source Solar PV Program From AEP Texas

This solar program from AEP caters to customers in the company’s service territory (which covers 97,000 square miles in west and south Texas). It’s a one-time incentive that can yield savings of up to $3,000 per system and is available for systems up to 30 kW.7

Austin Energy Solar PV Rebate

This solar rebate applies to customers in the Austin area who have systems of 3 kilowatts or more. They must also take a solar course before their system gets installed.8

This one-time incentive can result in a maximum of $2,500 in savings for each system.

How Can I Sell Power to Texas?

Many people who install solar sheets on their property also want to know about the process of selling solar power to generate income (also known as net metering).

Net metering is a type of buyback program.28 It gives a customer credits for extra energy that their solar panels produce and send back to the power grid. Those credits go toward future energy bills and help you save on electricity even during months when your system doesn’t entirely eliminate your power bill.

Texas does not have a statewide net metering program. However, many of the state’s utility companies, as well as retail electricity providers, offer net metering options for customers with solar panel systems.

The following are some of the most well-known private utility providers that allow customers to sign up for net metering programs:

- Almika Solar29

- Amigo Energy30

- Champion Energy Services31

- Chariot Energy32

- Energy Texas33

- Gexa Energy34

- Green Mountain Energy35

- Just Energy36

- Octopus Energy37

- Reliant Energy38

- Rhythm Energy39

- Shell Energy40

- TXU Energy41

Why Does Texas Have So Many Electricity Options?

Texas is unique because of its deregulated energy market.

Residents are able to shop around for their electricity provider and choose one that offers the plans and services that best meet their needs, including the need for solar energy solutions.

What Is Needed To Qualify for Solar Credits?

To qualify for the federal solar tax credit, you must meet these specific standards:42

- You’ve made solar-related improvements to your main home (i.e., the place where you live most of the time)

- You’ve paid for the system in cash or through a loan (i.e., you’re not leasing the panels or part of a power purchase agreement)

Can Home-Based Business Owners Qualify for Solar Credits?

Keep in mind that if you use your home for business, you may or may not be able to qualify for the credit.

If business use is at or below 20%, you can still claim the full credit. However, if the business uses more than 20% of the home, the credit is only based on the non-business-use percentage.

Who Qualifies for Utility Company Rebates?

Typically, if you are a customer of a company with a rebate program, you live in that company’s service area, and you have had a solar panel system installed, you can apply and receive the rebate. However, some companies also have their own unique requirements.

The table below compares the specific qualifications for some of the rebate programs discussed earlier in this guide:

| Utility Provider | Rebate Qualifications |

| Oncor |

|

| AEP Texas Solar PV Incentive Program |

|

| Austin Energy Solar PV Rebate |

|

How Much Do Solar Panels Cost in Texas?

While many people want to experience the perks of solar arrays, they also have questions like, “Are solar panels affordable?”, “What does it cost to connect solar to my home?”, and “How much do solar panels cost?”

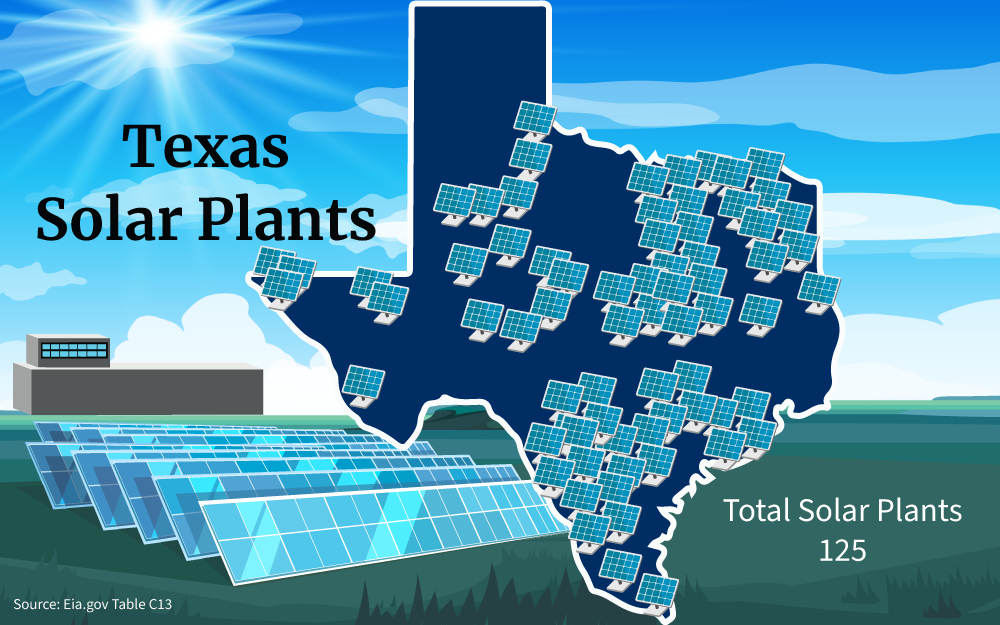

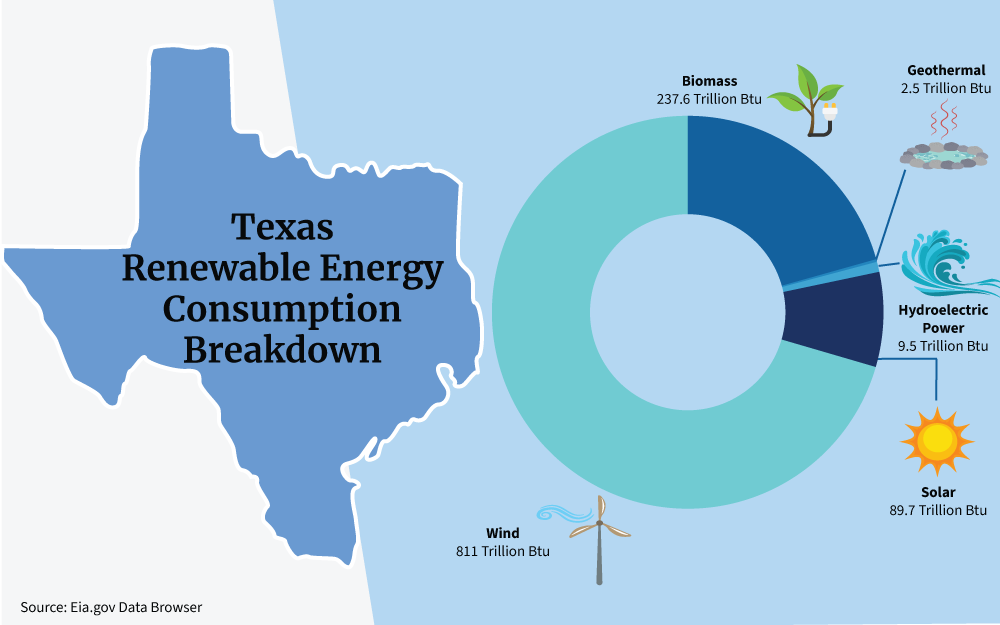

Currently, Texas has a large renewable energy consumption outlook, but adding home solar energy systems into the mix can increase the state’s green energy outlook.

The exact price of your solar panel system depends on a lot of factors, including these:

- Roof type: Some roofing materials (shingles, metal, etc.) are more amenable to solar panels than others and require less labor during the installation process.

- Roof size: The larger your roof is, the more panels you might need to cover it.

- Roof Azimuth angle: The roof’s azimuth angle determines the amount of sun exposure solar panels get throughout the day, which in turn influences the number of panels you need.9

- Panel type: Most homes have either monocrystalline panels or polycrystalline panels; Monocrystalline panels are more efficient than polycrystalline ones, but polycrystalline ones are more affordable.10

The cost of your system also varies based on the cost of panels in your state. In Texas, the average panel costs $2.72 per watt.11 If you had a 5-kilowatt system (5,000 watts), you would pay around $13,600. Once you apply the federal tax credit, though, the price decreases to $9,520.

How Can I Finance Renewable Energy Solar Panels?

Even with the 30% federal credit factored in and combined with Texas solar incentives, some people may still worry about how they’re going to scrape together the money needed upfront to install solar panels.

If you’re in that position, you do have a few different financing and alternative renewable energy solar panels options to consider, including these:

Solar Loans

Many lenders offer solar-specific loans for customers who want solar panels but can’t afford the upfront cost.12 These loans typically include competitive rates and factor in things like maintenance to incentivize customers to switch to more energy-efficient solutions.

Those who choose to take out a solar loan can decide between secured and unsecured loans. A secured solar loan (just like a secured home or auto loan) uses some kind of collateral (like your house) that can have a lien placed against it if you don’t make your payments. An unsecured loan, conversely, doesn’t have any collateral attached to it.

Several banks and credit unions in Texas offer solar financing programs with varying rates and term lengths, including those compared in the table below:

| Solar Loan Availability | Term Length |

| Lightstream13 | Flexible term options |

| Home Loan Investment Bank14 | 3-20 years |

| Dividend Finance15 | 20 years |

| EnerBank USA16 | 12 years |

| Green Sky Credit17 | 12 years |

| Medallion Bank18 | 15 years |

| Mosaic19 | 10-20 years |

Instead of taking out a personal loan through your bank or one of the lenders listed above, you can also utilize other financing options to pay for your solar panels, including these:

- Home equity loans and lines of credit: These loans and lines of credit use your home as collateral. If you have sufficient equity in your home, you can borrow against that amount to pay for your solar panels.

- FHA 203(k): This type of loan lets you include the cost of certain home improvement projects (including solar panels) into a new or refinanced mortgage.

- Contractor financing: In some cases, solar contractors offer financing options to help customers offset the upfront costs of installing panels.

In certain parts of Texas, you can also qualify for the Property Assessed Clean Energy or PACE program.20

This is a loan program that gives solar panel system owners access to private, long-term (10-20 years on average), and low-rate financing to make solar panels (and other energy-efficient home improvements) more affordable.

PACE loans are not available in all parts of Texas (yet). However, you can use this interactive map to see if you live in an eligible location.21

Power Purchase Agreements (PPAs)

A power purchase agreement takes place between you and a solar developer.22

This third-party developer owns and installs the system. They also sell you the energy produced by the system (typically at a flat rate that is lower than your average monthly energy bill, although the rate may rise throughout the contract period).

Most power purchase agreements last between 10 and 25 years. Throughout that entire period, the developer is responsible for operating and maintaining your system to ensure it continues working correctly. At the end of the contract, you may either extend the agreement or, in some cases, purchase the system from the developer.

For many people, the upfront savings produced by a power purchase agreement are worthwhile. They also like that their monthly electric bill is a flat fee and doesn’t fluctuate much.

However, as is the case with solar panel leases, power purchase agreements don’t make you eligible for tax credits, so you likely won’t save as much in the long run.

Solar Installation Calculator Costs

The example shared above came up with a solar power estimate based on a 5-kilowatt system. What if your system is larger than that, though? How do you know what size of system you need?

You can do some simple math to estimate the number of panels you’ll need for your system. Start by calculating the following numbers:

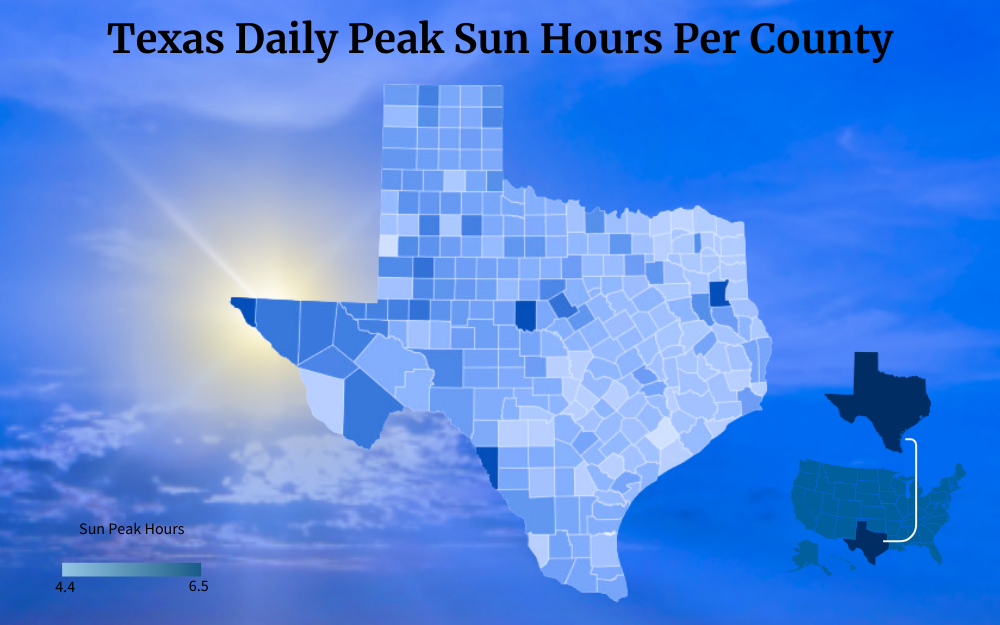

- kWh Usage: kWh usage refers to the amount of energy your home uses per hour; Texans use around 14,000 kWh per year.23

- Production Ratio: The production ratio estimates the amount of kWh/year a solar array can produce and divides it by the system’s total wattage; The average production ratio in Texas is 1.5-1.8.24

- Panel Wattage: The average solar panel efficiency ranges from around 250-400; The higher the efficiency, generally, the fewer panels you’ll need.

Once you’ve calculated those three numbers (or determined your best estimate), you can use this equation to calculate the approximate number of panels your home requires:

kWh usage/production ratio/wattage = Number of panels required

Using the numbers from above, the equation might look like this:

14,000/1.5/250 = 37.33 (rounded up to 38)

With increased solar panel wattage (400) and a higher production ratio (1.8), the panel number drops to 19.4 (rounded up to 20).

Remember that these numbers are just estimates to help you get started. You could end up needing more or fewer panels than the number you calculate using the equation above.

How Much Can You Save When You Add Solar Panels to a Home?

The average monthly electric bill for Texas residents is $132.40.25

Because of how sunny Texas is (the state gets an average of 5,137 Kilojoules per square meter), switching to solar could likely knock out that bill completely (or at least steeply discount it).26

After just one year of having solar panels installed, based on those numbers, you could save $1,588. Over the lifespan of your solar panel system (25-30 years), that could add up to between $39,700 and $47,640 saved (and that’s without accounting for increases in the cost of electricity).27

What Is Needed To Qualify for Solar Credits?

To qualify for the federal solar tax credit, you must meet these specific standards:42

- You’ve made solar-related improvements to your main home (i.e., the place where you live most of the time)

- You’ve paid for the system in cash or through a loan (i.e., you’re not leasing the panels or part of a power purchase agreement)

How To Find TX Solar Panels

Texas is home to over 500 solar panel companies (including over 300 installers and manufacturers), so you have plenty of providers to choose from.43

How do you know you’re making the best choice, though? Start with these best practices:

- Look for an experienced installer: Find someone who has been working in the field for several years and is familiar with the challenges you might encounter when installing a system on your property.

- Look for a local installer: Local installers will be more aware of the proper protocol for installing panels on houses like yours.

- Ask them to explain their process: Make sure they can answer basic questions like “What does solar panels do?” and more advanced ones like “What is the solar process that results in the production of energy?”

- Check their license and insurance information: This step helps you ensure they’re running a legitimate business; It can also help you find out if they have any formal complaints against them as well.

- Compare quotes: Get quotes from several installers to ensure you’re getting a fair price; Remember, though, that the lowest price doesn’t always point to the best company for the job.

- Review contracts carefully: A thorough review ensures you understand exactly what you’re agreeing to (especially if you’re considering a solar panel lease or power purchase agreement).

Remember to take your time when making a multi-thousand-dollar decision like this, too.

Don’t give in to pressure from salespeople who might not have your best interests in mind. If they trust in their product and services, they won’t be in a hurry to get you to sign a contract.

Are Solar Panels Toxic?

So, are solar panels toxic? The beneficial environmental impacts of solar energy are well-known.

However, are there any negative effects to be aware of?44

To address this question, you must first know the answer to the question, “What are solar panels made of?”

By weight, a standard solar panel is typically composed of the following materials:45

- 76% glass

- 10% plastic

- 8% aluminum

- 5% silicon

- 1% copper

- Less than 0.1% silver and other metals (lead, cadmium, etc.)

At high levels, some of the metals used in solar panels, such as lead and cadmium, can be harmful to human health and the environment.46 However, because they’re present in such small amounts, they’re not hazardous to the average person.

Disposing of TX solar panels properly at the end of there can also mitigate these risks and protect people and the environment from unintentional exposure.

The EPA also offers guidelines on where to dispose of and recycle solar panels safely.47 They’re usually recycled at glass recycling facilities, though, since that is the primary material of which they’re composed.

With the heat and frequent sunshine that Texas gets, it makes perfect sense why the state is ranked second in the nation for installed solar.

Do you want to join the thousands of people who have installed solar panels on their homes? If so, use the information shared above to calculate the approximate cost of your system, take advantage of applicable credits and Texas solar incentives, and choose the best installer for your property.

Frequently Asked Questions About Texas Solar Incentives

How Do I Know if a PACE Program Is Available in My Area?

There is an interactive map to see if a program has been created in your county. Be sure to check regularly, as the program’s reach is continuously expanding.

Does Texas Get Around 700 Hail Incidents Per Year? Will My Panels Be Safe?

Solar panels are very durable and will likely withstand most hail incidents.

Ask your solar contractor about their hail impact tests for additional information on how safe and durable your system will be. As a bonus, their response can also help you determine the contractor’s expertise and legitimacy.

Can I Get Cash for Extra Energy Generated By My Solar Panel System?

Some energy retailers offer cash as part of their net metering program, including Octopus Energy.51 However, most simply allow your credits to roll over and go toward the next month’s bill.

References

1Solar Energy Industries Association. (2023). State Solar Spotlight | Texas. SEIA. Retrieved September 15, 2023, from <https://www.seia.org/sites/default/files/2023-09/Texas_0.pdf>

2Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

3Office of Energy Efficiency & Renewable Energy. (2023). Office of Energy Efficiency & Renewable Energy Homepage. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/eere/office-energy-efficiency-renewable-energy>

4Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit#works>

5Hegar, G. (2022, May). Solar and Wind-Powered Energy Device Exemption and Appraisal Guidelines. Texas Comptroller. Retrieved September 15, 2023, from <https://comptroller.texas.gov/taxes/property-tax/docs/96-1569.pdf>

6ONCOR Electric Delivery Company LLC. (2023). YOU CHOOSE SAVINGS YOUR WAY. Oncor. Retrieved September 15, 2023, from <https://www.oncor.com/takealoadofftexas/pages/residentialsolar>

7AEP Texas. (2023). AEP Texas Solar PV Incentive Program Homepage. AEP Texas. Retrieved September 15, 2023, from <https://www.txreincentives.com/>

8Austin Energy. (2023, March 1). Solar Photovoltaic (PV) Rebate & Incentives. Austin Energy. Retrieved September 15, 2023, from <https://austinenergy.com/green-power/solar-solutions/for-your-home/solar-photovoltaic-rebates-incentives>

9Cornwall, C., Horiuchi, A., & Lehman, C. (2023, September 15). NOAA Solar Position Calculator. NOAA. Retrieved September 15, 2023, from <https://gml.noaa.gov/grad/solcalc/azel.html>

10Solar Energy Technologies Office. (2019, December 3). PV Cells 101: A Primer on the Solar Photovoltaic Cell. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/eere/solar/articles/pv-cells-101-primer-solar-photovoltaic-cell>

11EnergySage, Inc. (2023, March 15). Texas Solar Panel Cost: Is Solar Worth It In 2023? EnergySage. Retrieved September 15, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/tx/>

12Office of Energy Efficiency & Renewable Energy. (2016, July 28). Paying For Solar – Tips For Financing a Residential System. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/eere/articles/paying-solar-tips-financing-residential-system>

13Truist Financial Corporation. (2023). Loans for Practically Anything. LightStream. Retrieved September 15, 2023, from <https://www.lightstream.com/>

14Home Loan Investment Bank. (2023). Home Loan Investment Bank Homepage. Home Loan Investment Bank. Retrieved September 15, 2023, from <https://www.homeloanbank.com/>

15Fifth Third Bank, National Association. (2023). Solar and Home Improvement Financing. Dividend Finance. Retrieved September 15, 2023, from <https://www.dividendfinance.com/>

16Regions Bank. (2023). EnerBank USA: Home Improvement Loans for Homeowners. EnerBank USA. Retrieved September 15, 2023, from <https://enerbank.com/>

17GreenSky, LLC. (2023). Get There Faster. GreenSky. Retrieved September 15, 2023, from <https://www.greensky.com/>

18Medallion Bank. (2023). Consumer Finance Worth Finding. Medallion Bank. Retrieved September 15, 2023, from <https://www.medallionbank.com/>

19SOLAR MOSAIC LLC. (2023). Financing For Solar Energy Systems & Home Improvements. Mosaic. Retrieved September 15, 2023, from <https://joinmosaic.com/>

20Texas PACE Authority. (2023). What is PACE? Texas PACE Authority. Retrieved September 15, 2023, from <https://www.texaspaceauthority.org/what-is-pace/>

21Texas PACE Authority. (2023). TX-PACE Service Areas. Texas PACE Authority. Retrieved September 15, 2023, from <https://www.texaspaceauthority.org/service-areas/>

22U.S. Department of Energy. (2023). Power Purchase Agreement. Better Buildings Initiative. Retrieved September 15, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

23U.S. Energy Information Administration. (2009). Household Energy Use in Texas. EIA. Retrieved September 15, 2023, from <https://www.eia.gov/consumption/residential/reports/2009/state_briefs/pdf/TX.pdf>

24Thoubboron, K. (2018, March 6). How Solar Installers Calculate Solar Production Estimates. EnergySage Blog. Retrieved September 15, 2023, from <https://news.energysage.com/solar-installers-calculate-solar-production-estimates/>

25U.S. Energy Information Administration. (2023). 2021 Average Monthly Bill- Residential. EIA. Retrieved September 15, 2023, from <https://www.eia.gov/electricity/sales_revenue_price/pdf/table5_a.pdf>

26Victor, T. (2023, May 8). These Are Officially The 12 Sunniest States In The United States. AZ Animals. Retrieved September 15, 2023, from <https://a-z-animals.com/blog/these-are-officially-the-12-sunniest-states-in-the-united-states/>

27Environmental Protection Agency. (2023). End-of-Life Solar Panels: Regulations and Management. Environmental Protection Agency. Retrieved September 15, 2023, from <https://www.epa.gov/hw/end-life-solar-panels-regulations-and-management>

28Shah, C. (2014, May 8). Net Metering. US Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/sites/prod/files/2014/05/f15/fupwg_may2014_net_metering.pdf>

29Almika Solar. (2021). Almika Solar Homepage. Almika Solar. Retrieved September 15, 2023, from <https://almikasolar.net/>

30Amigo Energy. (2023). Amigo Energy Homepage. Amigo Energy. Retrieved September 15, 2023, from <https://amigoenergy.com/>

31Champion Energy Services, LLC. (2023). Residential Energy Services. Champion Energy Services. Retrieved September 15, 2023, from <https://www.championenergyservices.com/>

32174 Power Global Retail Texas, LLC, dba: Chariot Energy. (2023). Electricity Plans Powered by Renewable Energy. Chariot Energy. Retrieved September 15, 2023, from <https://chariotenergy.com/>

33Energy Texas. (2023, September 18). Uncomplicated Texas Electricity Rates and Plans. Energy Texas. Retrieved September 18, 2023, from <https://www.energytexas.com/>

34Gexa Energy, LP. (2023). Gexa Energy: Customize Your Energy for Home or Business. Gexa Energy. Retrieved September 15, 2023, from <https://www.gexaenergy.com/>

35Green Mountain Energy Company. (2023). 100% Renewable Energy Company. Green Mountain Energy. Retrieved September 15, 2023, from <https://www.greenmountainenergy.com/>

36Just Energy. (2023). Electricity Company & Gas Supplier 866-288-3105. Just Energy. Retrieved September 15, 2023, from <https://justenergy.com/>

37Octopus Energy LLC. (2023). Switch to affordable renewable energy. Octopus Energy US. Retrieved September 15, 2023, from <https://octopusenergy.com/>

38Reliant Energy Retail Holdings, LLC. (2023). Texas Home & Business Electricity. Reliant Energy. Retrieved September 15, 2023, from <https://www.reliant.com/>

39Rhythm Ops, LLC. (2023). Texas Electricity | 100% Renewable Energy Plans. Rhythm Energy. Retrieved September 15, 2023, from <https://www.gotrhythm.com/>

40MP2 Energy Texas LLC. (2023). Shell Energy homepage. Shell Energy. Retrieved September 15, 2023, from <https://shellenergy.com/>

41TXU Energy Retail Company LLC. (2023). Texas Energy | Residential & Business Electricity. TXU Energy. Retrieved September 15, 2023, from <https://www.txu.com/en>

42Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit#qualifies>

43Graves, P., & Wright, B. (2018, April). Solar Power in Texas. Texas Comptroller. Retrieved September 15, 2023, from <https://comptroller.texas.gov/economy/fiscal-notes/2018/april/solar.php>

44Office of Energy Efficiency & Renewable Energy. (2023). Benefits of Residential Solar Electricity. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/energysaver/benefits-residential-solar-electricity>

45Hoffs, C. (2022, October 19). How Are Solar Panels Made? – Union of Concerned Scientists. UCS blog. Retrieved September 15, 2023, from <https://blog.ucsusa.org/charlie-hoffs/how-are-solar-panels-made/>

46U.S. Energy Information Administration. (2022, February 25). Solar energy and the environment. EIA. Retrieved September 15, 2023, from <https://www.eia.gov/energyexplained/solar/solar-energy-and-the-environment.php>

47Environmental Protection Agency. (2023, June 20). Solar Panel Recycling. Environmental Protection Agency. Retrieved September 15, 2023, from <https://www.epa.gov/hw/solar-panel-recycling>

48Photo by Staff Sgt. Christopher Calvert. dvidshub.net. Retrieved from <https://www.dvidshub.net/image/1510345>

49Screenshot of Texas Form 50-123. Comptroller.texas.gov. Retrieved from <https://comptroller.texas.gov/forms/50-123.pdf>